Trading the QQQ or Its Derivatives

The QQQ is an ETF and it is one of the most popular trading vehicles in existence. Why is it so popular? This article discusses some of its biggest advantages.

Diversification

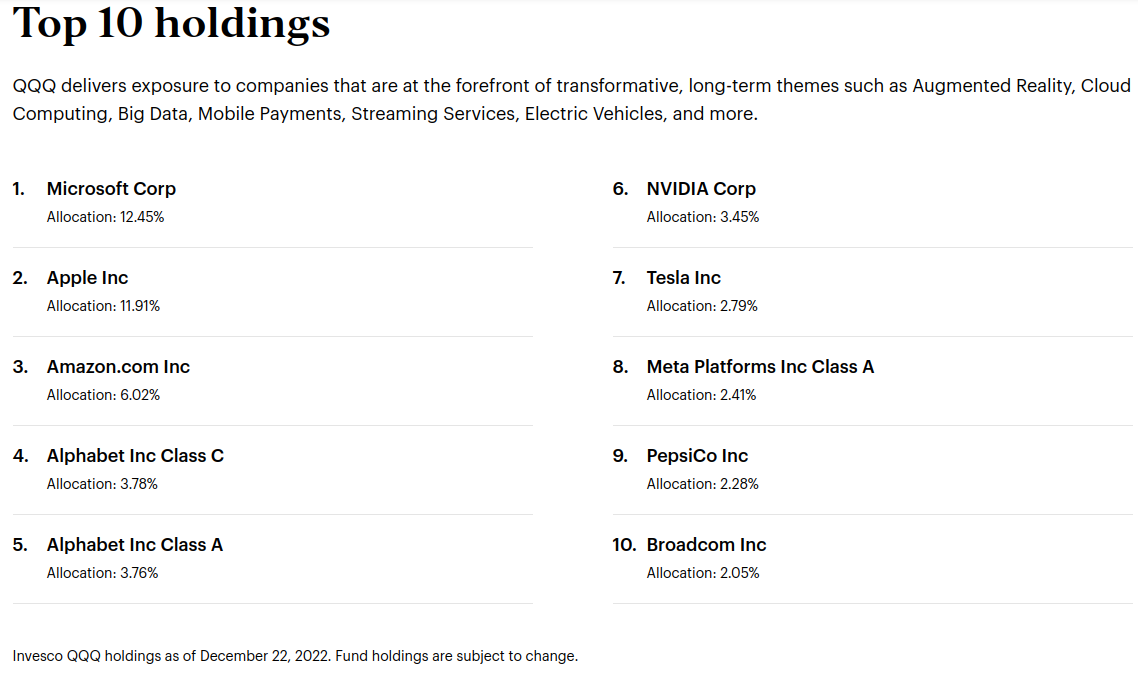

One of the main reasons is that it is automatically diversified. As of 2022-12-22 it was holding 101 companies. Here are the top 10:

So you can see that the QQQ is comprised of the biggest technology companies. You won't have to worry about waking up one morning to find out that the SEC has launched an investigation into the one stock you're holding. Yes, that does happen!

Diversification is key to limiting risk in the stock market. There are many studies that talk about the optimal number of stocks to hold in a portfolio, and the consensus is anywhere between 20 and 50. It can be cumbersome to have to manage that many positions, and that gets to the next advantage of trading the QQQ: convenience.

Convenience

By the same token, being able to trade all of these companies in one security is really convenient. Imagine placing buy and sell signals for all 101 companies that the QQQ currently holds. It would almost be a full-time job. You could write a program to trade all of these companies at once, but why would you when the QQQ already exists?

Performance

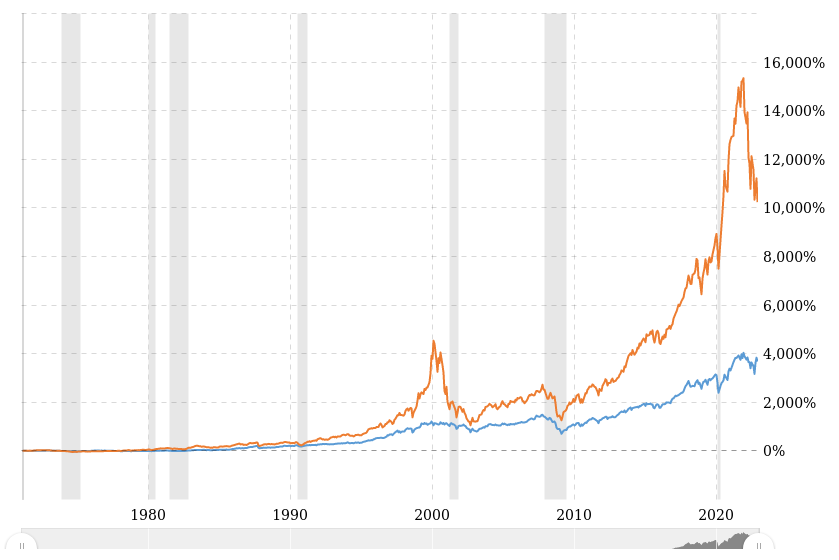

The QQQ tracks the NASDAQ 100, which has been an engine of growth for the US economy for decades. Here's a chart comparing the NASDAQ to the Dow Jones Industrial Average since 1980.

It's really not even close.

Yes, it's certainly more volatile, but if you can stomach those swings, well, in the long run you'll be golden.

OK, So What?

You've convinced me, you say. I should trade the QQQ at least for part of my equity exposure. What's the best way to do it? Everyone knows the stock market is a great way to invest, but people tend to make trading decisions at exactly the wrong time: buying at tops and selling at bottoms.

Financial news is driven by greed and fear just like trading itself. The news outlets know that viewership goes up when people are afraid (to a point) so they push certain narratives.

Buy and Hold

For a lot of people it makes sense to just buy stocks and hold them forever. It's easy and it works. And if you dollar-cost average, that is, buy on a regular schedule, say, every two weeks or every month when you get your paycheck, you can do pretty well.

Swing Trading

Most people want better performance out of their investments, and that's where a trading strategy comes in. I highly encourage people to devote time to creating their own trading system. Do what works for you! But I can tell you from experience that this is easier said than done. Just collecting the data to backtest a trading strategy is difficult. But again, what drives this is the pursuit of performance. Even a small increase in performance translates into a big difference over time because of the power of compounding.

Bottom Line

Trade the QQQ. Use a trading strategy. Prosper.